As an online food delivery platform, Deliveroo's business model has three major stakeholders: the customers who use the platform to order food, the restaurants that prepare the food and the delivery riders who transport the food to Deliveroo’s hungry clients.

Each day, Deliveroo riders set out into bustling city traffic to deliver their orders. Despite extensive safety guidelines and training, accidents do happen.

And since delivery riders are particularly vulnerable, Deliveroo needed insurance that would cover its riders in case of an accident.

Another consideration is that if riders are found to be at fault in an accident, they could be held liable and exposed to serious financial consequences. For an individual rider, it's very difficult to find a quality insurance product that covers their unique situation.

So Deliveroo decided that offering insurance to their riders was crucial, which gave the company a competitive edge, helped them attract even more talent and retain the best riders.

The goal was to roll out the delivery rider insurance to gig workers in Belgium, where the idea originated, with the hopes of expanding throughout Europe to France, the Netherlands, Italy, Spain, Ireland and the UK.

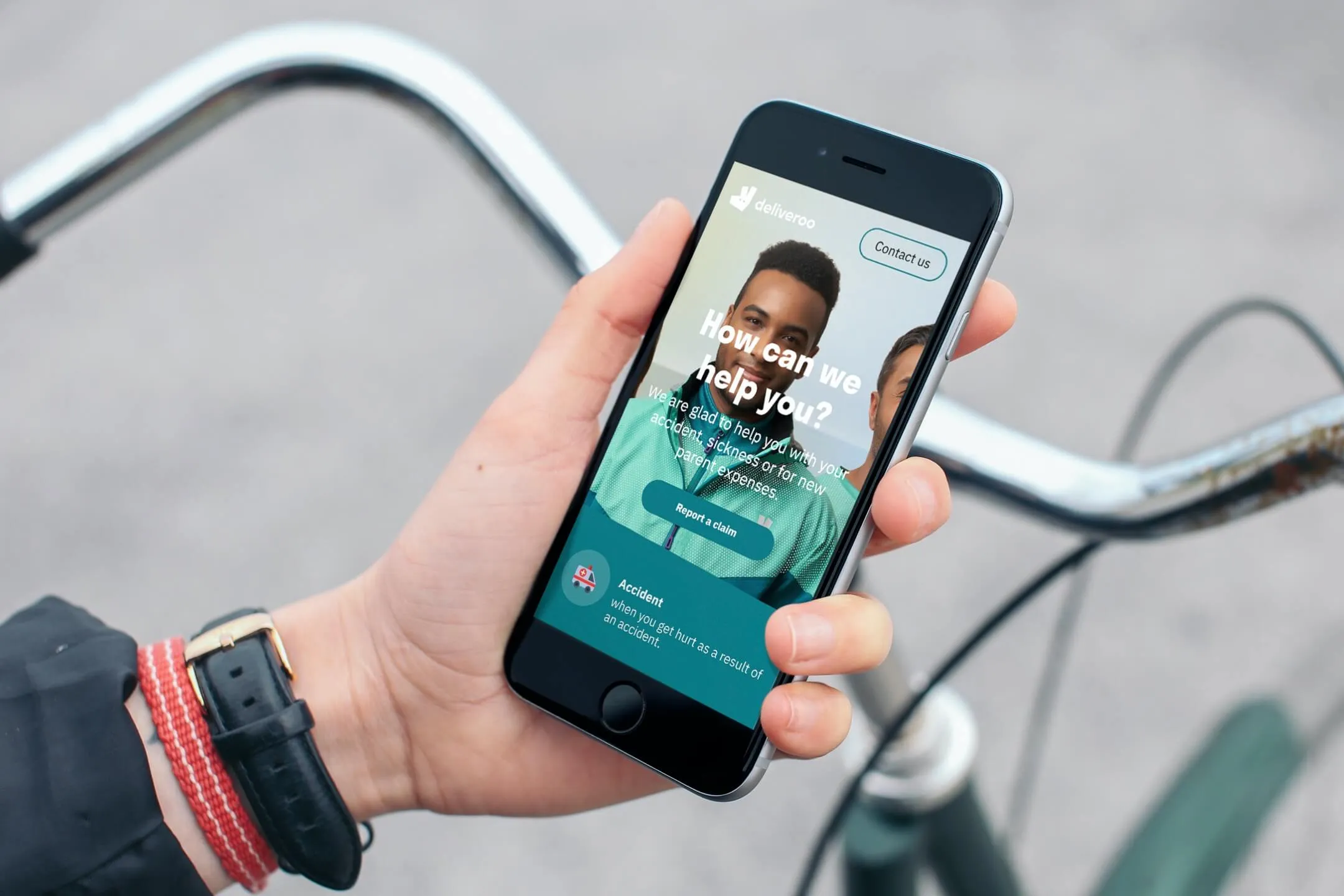

At Qover, we leveraged our unique pan-European insurance platform – which handles everything from IT integration to a custom insurance solution to exceptional customer care – in order to connect the proposed insurance solution with the Deliveroo rider app.

As part of the process, our dedicated teams scoured the market to find the best insurance partner for this unique solution and identified Wakam as an ideal candidate.

Our customer care team – centrally located in Brussels – scaled at pace with Deliveroo’s growth while maintaining an excellent customer satisfaction score.

Our insurance platform allowed Deliveroo to scale its operations while maintaining a 90% customer satisfaction score.

We delivered a pan-European insurance solution combined with customer care available in 10+ languages, so that the company’s local offices were free to focus on what they do best.

After a successful first proof of concept in Belgium in 2017, we added six more countries in less than 30 days.

The partnership between Qover and Deliveroo continues to evolve: in 2021 and earlier 2022, Deliveroo added new sickness cover and parental benefits for France, Belgium and Ireland.

In 2022, we worked to make the claims process speedier for Deliveroo couriers by insourcing all claims through Qover’s team.

Today, close to 45,000 Deliveroo riders across five European countries are covered while working.

At Qover, we’re available in each country to help local markets with their specific insurance needs. For example, Deliveroo riders in France were having difficulty finding suitable insurance for their own bikes.

In response, we developed a dedicated product for this community with a flexible subscription model, offering monthly and yearly options.

With years of experience developing embedded insurance solutions for the gig economy, we help high-growth businesses like Deliveroo harness the power of insurance to protect their gig workers and attract new talent.