7 most popular embedded insurance products for banks in 2025

In a nutshell

- Embedded insurance products like purchase protection, travel cover and device protection are becoming must-haves for banks looking to add value and grow loyalty.

- Banks should align their insurance offering with customer needs, business goals and regulatory realities – while ensuring a seamless digital experience.

- Benefits include boosting wallet share, strengthening premium plans and improving customer satisfaction.

- Choosing the right partner makes it easier to launch quickly, scale across markets and deliver claims processes that meet modern expectations.

Banking customers expect more than just a safe place to store their money. They want super app services that fit seamlessly into their lives.

One survey found that 3 in 4 fintech users are interested in insurance from their banks.

From travel cover booked alongside flights to purchase protection built into their payment cards, embedded insurance products are reshaping how banks connect with their customers.

Today, both traditional banks and digital-first players are embracing these solutions – whether by dipping into the insurance space for the first time or boosting current offerings with new products – to stay competitive, increase account usage and strengthen customer relationships by making everyday banking activities feel safer and more rewarding.

In this guide, we explore the 9 most popular embedded insurance products for traditional and digital banks, why they’re in demand and how you can choose the right ones for your strategy in 2025.

The benefits of embedded insurance for banks

Embedded insurance isn’t just an extra perk; it can be a strategic growth driver for financial services players looking to strengthen customer relationships and improve the customer experience.

Whether you’re launching a brand-new program or building on what you already offer, the right insurance products can make a tangible difference to your bottom line and your brand.

- Boost customer value: increase wallet share by integrating relevant, high-value insurance coverage into your plans. Retain customers on premium tiers and improve overall satisfaction with benefits they actually use.

- Enhance the user experience: deliver seamless digital touch points across the banking experience, from onboarding to claims. Make sure your insurance provider uses user-centric terms and transparent coverage that match modern customer expectations.

- Launch and expand quickly: work with a tech partner to bring new insurance programs or products to market in a matter of months or even weeks.

- Optimise performance: embedded insurance is a tech-first experience. That means streamlined claims handling and customer support for faster resolutions. Partners that prioritise data transparency and analytics allow you to continually improve coverage and UX over time.

When done well, embedded insurance becomes more than just a feature. It’s a way to future-proof your offering and create lasting value for your customers.

Read more: 5 things next-gen fintechs should know about embedded insurance →

Top embedded insurance products for banks & money apps

1. Purchase protection

Purchase protection is often where banks start their embedded insurance journey. This type of coverage protects eligible items purchased with a customer’s account against damage, theft or loss after they’ve been delivered.

By embedding purchase protection into a payment card or paid plan, customers are incentivised to use their account more often and for higher-value purchases. There’s data to back this up: 60% of fintech users say they would use their accounts more often if it came with insurance.

For example, if a customer orders a designer handbag and a strap breaks a month later, they’re covered for the repair or purchase price. If it’s stolen from their front door after delivery, they could receive a full refund.

Coverage windows can be tiered. For example, a standard plan might include 90 days, while a premium plan extends that to 180. The key is offering the right level of protection to support your acquisition and engagement strategy.

By providing peace of mind, you can add real value to your offering and make sure you remain competitive in the banking space.

2. Travel insurance

Travel insurance is one of the most in-demand embedded insurance products for banks and fintechs.

With an increasing number of financial services players leveraging embedded travel insurance, it’s important to determine which type of coverage makes sense for your audience. This can range from covering flight delays and cancellations to lost luggage, medical expenses and assistance abroad.

You can offer basic travel coverage in your standard plan, and increase protection in higher-tier plans, with add-ons like skiing and extreme sports coverage or increasing limits for reimbursement.

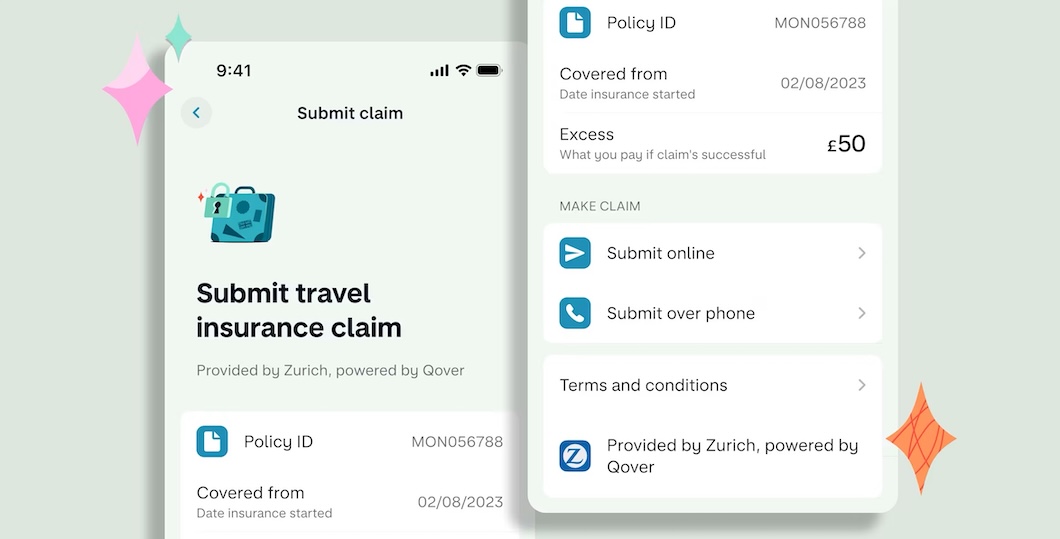

For instance, Monzo’s travel insurance in the UK includes a range of coverage, from travel inconvenience to leisure protection for car rentals and winter sports.

If you’re looking to further differentiate your plans with a top-tier insurance offer, you can go the Revolut route with cancel for any reason insurance.

When Revolut announced their Ultra plan, they wanted to give users ultimate flexibility. While most travel insurance policies require a set list of reasons to be eligible, such as illness or emergencies, cancel for any reason coverage allows users to do exactly that.

Learn more: see how fintech bunq is enhancing the user experience with embedded travel insurance →

3. Device protection or mobile phone insurance

Device protection is one of the most tangible ways to show customers you’ve got their back. With how tied we are to our phones, laptops and tablets, replacing or repairing them can be a costly hassle.

By embedding device protection into your account offering, you can cover users for common issues like cracked screens, liquid damage or theft for up to 12 months after purchase. This means when a customer’s phone slips out of their hand or their laptop is stolen on holiday, they can get it repaired or replaced without the stress.

This could be especially enticing for mobile-first customers. Digital banks like Revolut and Monzo offer device protection as part of higher-tier plans, with dedicated terms, pricing and claim processes. N26 recently embedded mobile phone insurance into their premium plan after cross-selling it as a standalone insurance policy.

Selling insurance products in a transactional model requires a complex strategy to really pay off, which is a challenge even for established financial services players, and one that can be especially tough for fintechs with leaner resources.

Embedded coverage, on the other hand, offers a more sustainable way to create long-term value.

4. Event cancellation protection

Few things are more disappointing than missing a big event you’ve been looking forward to, whether it’s a concert, theatre show or football match. But sometimes, life happens.

With event cancellation protection – sometimes called ticket cancellation protection – customers can get reimbursed when they can’t make it due to illness, injury, transport disruption or other unexpected events. This extra layer of financial security makes it easier for people to plan ahead with confidence.

One is example is the bank ING, which includes event cancellation coverage in their ‘Do More’ pack, giving users extra flexibility and a more seamless banking journey.

By protecting your customers’ experiences, you’re not just reducing their risk – you’re creating a more loyal, engaged user base that sees your bank as a partner in everyday life.

5. Cyber protection

As banking becomes more digital, so do the threats. Phishing emails, malware and fake websites can put your customers’ finances at risk.

Cyber protection offers coverage against losses caused by common cybercrime tactics like phishing and pharming.

Business finance solution Qonto includes phishing cover on some of their payment cards. If a customer is tricked into making a payment on a fake website, or that third party then uses their Qonto card to make a fraudulent payment or transfer, phishing protection steps in.

By pairing cyber protection with education on safe online practices, customers can feel more confident using digital channels.

6. Online shopping protection

Online shopping protection is designed to give customers complete confidence when buying from any retailer, whether it’s a small online shop or a global marketplace.

It covers the most common problems that can arise before or during delivery:

Non-delivery and delivery issues

If goods never arrive, arrive damaged or aren’t as described, your customers can be reimbursed for the purchase value or the cost of returning them. This also includes situations where the retailer refuses a refund or replacement, helping customers shop online without worrying about unreliable sellers or poor fulfilment.

Mastercard, for example, has successfully used return shipping cost protection to refund Mastercard customers when retailers don’t provide free returns. This encourages account holders to route more of their online spending through their credit cards, enhancing the shopping experience, setting them apart in a competitive market and thereby strengthening loyalty.

Return refusals

Sometimes a customer simply changes their mind, but the retailer’s policy means they’re stuck with the item. Refund protection can step in here, reimbursing customers when return windows have passed or returns aren’t accepted for other reasons.

By bundling these protections, customers are covered whether something goes wrong with delivery or they decide the purchase isn’t right for them.

Together with purchase protection – which covers the item after it’s safely in their hands – you can create a comprehensive shopping benefit package.

7. Extended warranty

Extended warranty coverage gives customers extra peace of mind when making larger purchases like appliances, TVs or laptops.

When a manufacturer’s warranty ends, your coverage can step in – extending protection for up to two more years. If something goes wrong, customers can be reimbursed for repair costs or the full replacement value.

By including extended warranty in your product set, you encourage customers to make those bigger purchases using your account. Over time, this not only drives transaction volume but also rewards long-term, loyal customers.

How to choose the right embedded insurance products for your bank

Choosing the right embedded insurance products isn’t just about picking from a list of popular coverage types (although that’s a great place to start).

It’s about creating a seamless fit between your customers’ needs, your business goals and the operational realities of delivering those products at scale.

Here are some key factors to keep in mind:

- Start with customer needs: your product mix should solve real problems for your audience. Tools like customer surveys, focus groups and usage data can help you understand which protections they value most.

- Evaluate the business impact: consider the commercial side. Will the product increase loyalty? Drive more transactions? Make sure your selection process links each insurance product to a clear business objective, so you can measure success over time.

- Account for regulatory constraints: insurance is a highly regulated industry, and rules vary from country to country. A product that’s simple to launch in one market may be far more complex in another. That’s why it pays to work with a partner who can navigate this complexity and keep your program compliant across borders.

- Prioritise the customer experience: the insurance products you choose should enhance your user journey. That means clear terms and fast claims resolution. Our partner Yonder, a UK-based rewards credit card, switched from a traditional insurer because their users found the claims process slow and tedious. By choosing a more tech-enabled insurance partner, they created an experience that matched their digital-first brand – and customer satisfaction went up.

- Look for scalable technology: if your bank is planning to expand into new markets or add products over time, your partner’s technology should make that growth simple. The right platform can support multiple products, integrate into your existing systems, and adapt to local regulations without months of redevelopment work.

By combining customer insight with the right technology and regulatory expertise, you can build an embedded insurance offering that’s both valuable for your users and commercially sustainable for your bank.

Next steps to launching embedded insurance products in 2025

From purchase protection to bill protection, the most popular embedded insurance products for banks all have one thing in common: they create tangible value for customers while supporting long-term growth for your business.

Whether it’s driving more card transactions, building trust in your digital channels or strengthening loyalty with premium plan holders, choosing the right mix of products can make a real impact.

Your insurance offering should match your customers’ needs and your broader banking strategy. That means products that are relevant, experiences that are seamless and solutions that can scale across borders as your business grows.

Every bank is different – get in touch with us to see how the right insurance products can support your growth.